FREE Sign Up!

FREE Sign Up!

Incomplete Account Opening - Sign Up

Cash Upfront Account

Cash Upfront Account

Cash Upfront Account

Cash Upfront Account

Cash Upfront Account

Cash Upfront Account

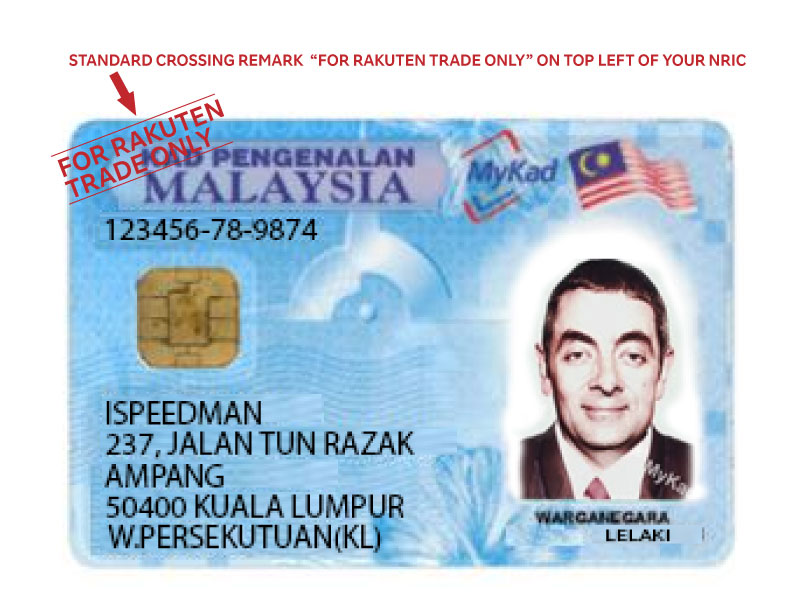

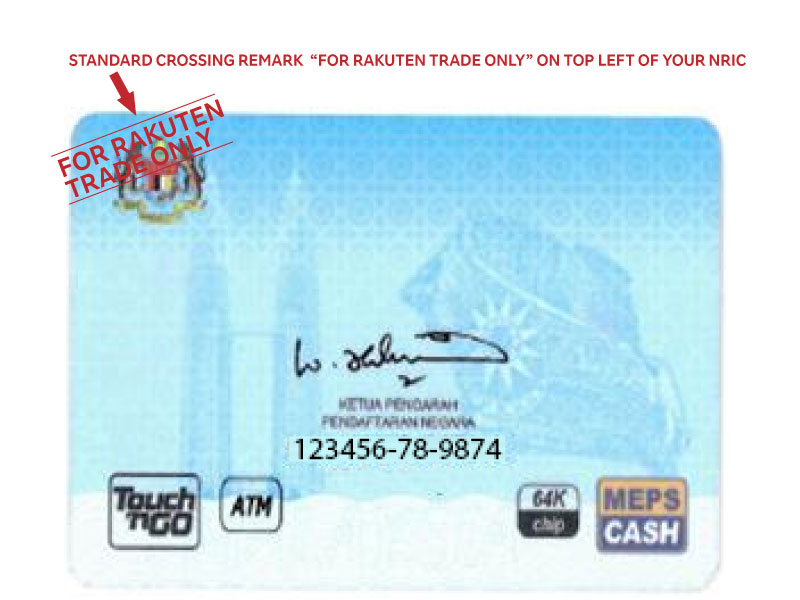

NRIC SAMPLE

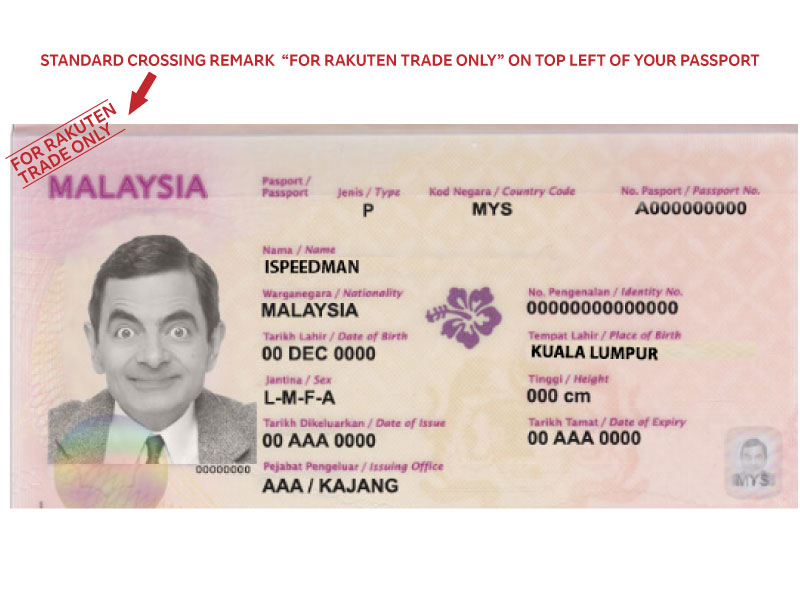

PASSPORT SAMPLE

PDPA Notices

GENERAL TERMS & CONDITIONS

GENERAL TERMS & CONDITIONS

GENERAL TERMS & CONDITIONS

Please note that capitalized terms may be a defined term. Please refer to Appendix A for the definitions.

| 1. | AUTHORISATION | |

| 1.1 | The Client hereby irrevocably and unconditionally authorises the Company to open and administer the Client’s Accounts as well as any other account(s) as the Company may deem fit for and on behalf of the Client to carry out the Client’s instructions issued to the Company on the Terms set out below. | |

| 2. | GENERAL | |

| 2.1 | The Form and the Terms shall form an integral part of the contractual relationship between the Client and the Company. The Company’s provision of Electronic Services to the Client shall be subject to the Terms, the contents in the Form and the Website Terms. | |

| 2.2 | By using the Electronic Services the Client acknowledges that the Client has received and understood these Terms and all other terms and conditions that also govern the Client’s Account(s) with the Company regardless of whether the Client executes the Form. | |

| 2.3 | Where the context requires, and the law permits, ‘the Company’ shall include subsidiaries or related companies of the Company (as defined under the Companies Act, 2016). The Companies Act 2016 shall also include any statutory amendments or re-enactment thereof and every other legislation made thereunder for the time being in force). | |

2.4 |

The Client agrees that, when presently and in the future the Client clicks on an “I Accept”, “I Consent” or other similarly worded “button” or entry field with his or her mouse, keystroke or other computer device, the Client’s agreement or consent will be legally binding and enforceable and the legal equivalent of the Client’s hand-written signature. | |

| 3. | COMPLIANCE WITH LAWS AND GUIDELINES | |

| 3.1 | The Client shall abide by all Laws and Rules including, without limitation, the Exchanges’ Rules relating to: | |

| 3.1.1 | the operation of the Client’s Account(s), Client’s Margin Account and the Client’s trading activities; | |

| 3.1.2 | the provision of Electronic Services; and | |

| 3.1.3 | all matters related to the transactions contemplated herein. | |

| 3.2 | The Client shall at all times adhere to and comply with all applicable AMLA provisions with respect to all transactions or matters whatsoever and howsoever arising whether directly or indirectly with the Company and in particular: | |

| 3.2.1 | shall disclose to the Company the particulars of the ultimate beneficial owner of the account(s) in the event the Client is not the ultimate beneficial owner of the said Client’s Account(s); and | |

| 3.2.2 | shall provide the Company with all relevant information and documents, as and when requested, for purposes of identification of the Client and verification of the Client’s source of funds under the Company’s prevailing “know your client” procedures. | |

| 3.3 | The Client agrees that it is subject to and governed by the requirements of the United States of America legislation known as the Foreign Account Tax Compliance Act 2010 (“FATCA”) and authorizes the Company to disclose account as well as transactional information for and in relation to FATCA to any party(ies) required under FATCA or to comply with FATCA and any arrangements thereto. | |

| 3.4 | The Client further acknowledges and agrees that any reportable Client’s Account(s) as well as any transactional information of the Client’s Account(s) may be provided to the tax authorities of the country/ jurisdiction in which such Client’s Account(s) is/are maintained and, exchanged with/ provided to, the tax authorities of another country/ jurisdiction in which the Client may bea tax resident of, pursuant to the intergovernmental agreements to exchange financial account information. | |

| 4. | ELECTRONIC SERVICES | |

| 4.1 | On the Client’s request for the Electronic Services, the Company shall provide Electronic Services to the Client solely for the Client’s own purposes and the Electronic Services shall not be extended for use by third parties. The Client agrees that all orders made through the Electronic Services shall be deemed to be confirmed and binding on the Client without any requirement to furnish proof to the Company. | |

| 4.2 | The Client acknowledges and understands that the Electronic Services is a communication and trading tool made available by the Company to the Client at the Client’s request to facilitate the communication between the Client and the Company and the trading of or dealing in Securities via the Internet. The Client also acknowledges that there are security, confidentiality and other risks in the use of the Electronic Services and the Internet which may be beyond the reasonable control of the Company and that, by electing to use and communicate through the Company’s Electronic Services and the Internet, the Client accepts that all communications between the Client and the Company are made at the Client’s sole risk. The Client agrees and accepts that prices of Securities quoted through the Company’s Electronic Services may change at any time and from time to time depending on the actual market conditions and accordingly, the Client’s orders in respect of dealings in Securities may not be executed or matched at the same prices as the prices then quoted through the Company’s Electronic Services at the time of the issuance of any such orders. | |

| 4.3 | The provision of Electronic Services shall be conditional on the Client’s compliance with the terms and conditions herein. The Client shall only be entitled to utilize the Electronic Services in strict compliance with any security or other requirements imposed by the Company in its absolute discretion. The Company may at any time impose conditions or other requirements to ensure that the integrity and security of the Electronic Services will not in any way be compromised and the Client shall comply strictly with all such conditions and requirements. | |

| 4.4 | The Client shall notify the Company in writing not later than 24 hours from the time the Client becomes aware of any of the following: | |

| 4.4.1 | loss or theft of the Client’s verification code, passwords, and/ or account numbers or other personal or security information relating to the Client’s Account(s) or the Electronic Services; | |

| 4.4.2 | unauthorized use or interception of any of the Client’s verification code, passwords and/ or account numbers or other personal or security information relating to the Client’s Account(s) or the Electronic Services or any information (data, facts, opinions and any other information provided through or in relation to the Electronic Services) | |

| 4.4.3 | failure by the Client to receive an acknowledgement from the Company that an order initiated by the Client through the Electronic Services has been received and/ or executed through the Electronic Services; | |

| 4.4.4 | receipt of confirmation of an order which the Client did not place, or any similarly inaccurate or conflicting report, account statement or information; | |

| 4.4.5 | failure by the Client to receive accurate conformation of an order or its execution, via Internet, electronic mail at the Client’s Internet address notified to the Company, within the same business day after entering the order through the Electronic Services; | |

| 4.4.6 | discrepancy between any report produced or made available to the Client by the Company on any medium (including electronic bulletin board), or in the Client’s portfolio, or an information source (including but not limited to third parties, stock exchange, company), and any other such report or confirmation of a trade order; | |

| 4.4.7 | if there is a discrepancy in the Client’s Account(s) balance, security positions or order status reported to the Client through the Electronic Services; and | |

| 4.4.8 | without prejudice to Clause 4.10, if there is any other type of discrepancy or suspicious or unexplained occurrence or activity relating to the Electronic Services or the Client’s Account(s) and/ or the access or use of the same. | |

| 4.5 | Electronic Services fees shall include: | |

| 4.5.1 | all subscription and service fees as may be prescribed by the Company from time to time for the provision of the Electronic Services which shall be payable monthly in advance on a non-refundable basis; and | |

| 4.5.2 | any other reasonable fees and charges as may be imposed by the Company at its sole discretion from time to time for Electronic Services rendered to the Client under the Terms herein. | |

| Enrolling and Use of the Electronic Services | ||

| 4.6 | The Client agrees and acknowledges that the Company requires the Client to provide a savings and/ or current bank account number with any financial institution in Malaysia which account is valid and able to effect electronic payment or telegraphic transfer to the Company. | |

| 4.7 | The Client agrees and acknowledges that the Company’s relevant service provider shall verify the Client’s bank account number to activate the use of the Electronic Services. The Company reserves the right to reject the account application for any reason including but not limited to an invalid bank account number provided by the Client. | |

| 4.8 | For online registration at the Company’s Website to use the Electronic Services the Client will be asked to set a profile for the Client’s Account and prompted to set the following: | |

| 4.8.1 | a User ID which must be in an alpha-numeric combination of between 6 and 12 characters/ digits; | |

| 4.8.2 | a numeric Trading PIN of 6-digits; | |

| 4.8.3 | a bank account number with a financial institution in Malaysia; | |

| 4.8.4 | security questions that will be presented to the Client, as part of the Client verification process that the Company will conduct when the Client places a telephone call to the Company for enquiry, etc pertaining to Client’s Account; and | |

| 4.8.5 | your primary e-mail address for receiving electronic communications as discussed above. | |

| 4.9 | Upon successful completion of the registration the Client shall utilize the Electronic Services by means of any or all of the following media: | |

| 4.9.1 | modem-equipped terminal or personal computer; | |

| 4.9.2 | touch screen terminals; or | |

| 4.9.3 | any other medium of communication that the Company may, in its absolute discretion, adapt or introduce for the Client’s use from time to time. | |

| 4.10 | The Client undertakes to safeguard any and all user names, passwords or other access codes, provided by the Company, and the Company may rightfully assume that any person using the Company Website with the Client’s user name and password is the Client. In this regard, the Client agrees that no claims shall be made by the Client or on its behalf in respect to any losses, costs and expenses incurred by the Client as a result of such unauthorized usage. | |

| 4.11 | The Company does not warrant the confidentiality or security of any information transmitted through the Internet. The Client accepts and agrees that the Company shall not be liable for any loss or damage arising from any electronic, mechanical, data failure or corruption, computer viruses, bugs or related problems that may be attributable to the Electronic Services provided by the Company or any relevant internet service provider, network provider or communication network provider. | |

| 4.12 | The Electronic Services are provided on an “as is”, “as available” basis and the Company makes no representation, warranty, condition or undertaking of any kind, whether expressed or implied in respect of any part of the Electronic Services or the reliability or quality thereof. The Client acknowledges that the Company has not given any such representations, warranties, conditions or undertakings in respect of any part of the Electronic Services or the reliability or quality thereof. | |

| 4.13 | The Client also agrees that the Client is solely responsible for the Client’s computer, system or other device from which the Client accesses the Company Website, including without limitation the maintenance, operation and permitted use of such computer, system or other device. | |

| 4.14 | The Client shall ensure that any computer, system or other device from which the Client accesses and uses the Client’s Securities portfolio is properly maintained and free from any defects, viruses or errors. It shall be the Client’s responsibility to ensure that the Client’s computer is loaded with the latest anti-virus and anti-spyware software and that the said software is at all times installed and updated. | |

| 4.15 | The Client shall not hold the Company or the Executing Broker liable in any manner whatsoever for the conduct of any Executing Broker over the Client’s Account, the Securities in the Client’s Account, access or unauthorized access to the Client’s securities portfolio and any matter related thereto. | |

| 4.16 | The Client agrees and acknowledges that Securities such as Leading Entrepreneur Accelerator Platform (LEAP) Market, leveraged and inverse exchange traded funds (ETFs) or any other Securities from time to time as notified by the Company is not available for trading on the Electronic Services. | |

| New Services, Hardware and Software | ||

| 4.17 | The Company may introduce new service(s) and/ or new product(s) through the Electronic Services at any time. By utilising such new service(s) and/ or product(s) as and when such new service(s) and/ or product(s) become available, the Client agrees to be bound by the terms and conditions as the Company may prescribe governing each such new service and/ or product. | |

| 4.18 | If new or different versions of the web browser or other software necessary for the operation of the Electronic Services are available, the Company reserves the right not to support any prior version of the web browser or other software. If the Client fails to upgrade the web browser, obtain a supported web browser or to use a supported version of any other software as required by the Company, the Company may reject instructions sent by the Client. | |

| 4.19 | The Company reserves the right to change the type or versions or specifications of any hardware or equipment that the Client may be required to use for the Electronic Services and in the event the Client fails to obtain the necessary hardware or equipment to use the Electronic Services, the Company may reject instructions sent by the Client or cease the Client’s access to or use of the Electronic Services. | |

| 5. | ORDERS & INSTRUCTIONS | |

| 5.1 | Orders can only be given by the Client during BMSB trading hours or during the trading hours of the relevant Stock Exchange where global trading in Foreign Securities is applicable and subject to the Company having activated their ordering system for Electronic Services. Notwithstanding the above, the Company shall have the absolute discretion to vary and alter the time period of such instructions or orders. | |

| 5.2 | It is the Client’s sole responsibility to ensure that all orders and instructions communicated are accurate, correct and clearly transmitted. The Client hereby irrevocably and unconditionally authorizes the Company to act on and/ or accept all instructions, communications and/ or orders given, through the Electronic Services, without any requirement to furnish proof to the Company notwithstanding that such instructions, communications and/ or orders may have been given without the Client’s authority. | |

| 5.3 | Subject to Clause 5.4 all instructions transmitted to the Company through the Electronic Services shall be irrevocable and conclusive and the Company shall be entitled to act on such instructions (in whole or in part) in accordance with the terms and conditions herein or any amendments, additions, modifications, variations whatsoever of the same notwithstanding the Company’s receipt of any of the Client’s request to cancel or amend such instructions. For the avoidance of doubt, the Company shall not be taken to have received or to have notice of any request for cancellation or amendment of instructions from the Client until the Company communicates its receipt of the same to the Client. | |

| 5.4 | Upon receipt by the Company of any request to cancel or amend any instruction, the Company may, but shall not be obliged to, cancel or amend any instruction after the instruction has been transmitted to the Company. The Company shall use all reasonable efforts to act on the Client’s request for the cancellation or amendment prior to the Company’s execution of such instructions, but the Company shall have no liability whatsoever if such cancellation or amendment is not effected. In the event that the Company cancels or amends, attempts to cancel or amend, any instructions at the Client’s request, the Client shall be liable to pay any and all costs and expenses that may be incurred by the Company. For the avoidance of doubt, the Client shall be bound by the execution for the Client by the Company of any instruction (whether in whole or in part) if and to the extent that such instruction (or any part thereof) was not cancelled or amended by the Company for the Client pursuant to the Client’s request. | |

| 5.5 | All transactions executed or done by the Company pursuant to the Client’s instruction shall be binding on the Client. The Company hereby reserves the right to deactivate or revoke the Client’s access to and use of the Electronic Services if the Company suspects or has reason to believe that the instructions issued using the Client’s user name and/ or password are or have not been duly authorised by the Client. In such event, the Company may require the Client to re-apply for a new user name, password or other access codes and the Company shall not be liable for any loss arising from the deactivation or revocation of the Client’s access to and use of the Electronic Services. | |

| 5.6 | The Company shall not be under any duty to verify the identity of the person(s) giving those instructions or the accuracy or truth of such instructions and the Company shall not be held responsible or liable for any loss whatsoever (direct, indirect, special, consequential) that may result from unauthorized instructions. | |

| 5.7 | All order(s) shall be deemed to be made at the time received by the Company and in the format received. The Client acknowledges and accepts, without limitation or liability to the Company, that when placing orders for Securities, there will be times when a quoted price will change prior to the execution of the order(s) due to market circumstances and that not all order(s) will be executed in chronological sequence with the order(s) being placed. | |

| 5.8 | The Company shall not be liable to the Client for any losses or damages (whether direct or indirect) arising from any failure to receive or delay in receiving any order, instruction or communication issued by, for or on behalf of the Client nor for any delay, omission, interruption in transmission or wrongful interception of any order or instruction through any equipment or system. The Company, however, will endeavour to resolve any matter or issue arising from the Electronic Services and, where applicable, take such action which is consistent with market practice. | |

| 5.9 | The Client agrees that the Client must disclose the availability of Securities as tradeable balance for delivery purposes when instructing the Company to execute a sell order and to deliver to the Company promptly, any certificates, related valid transfer deeds and documents of title of Securities, where applicable, which the Company has sold on the Client’s behalf or ensure that the Client has “free Securities” in the Client’s CDS account on the Settlement Due Date or accept that the Company may effect a ‘buy-in’. | |

| 5.10 | In accordance with the Fixed Delivery and Settlement System (FDSS) established under the BMSB rules and/ or in compliance with any other Exchanges’ Rules and guidelines, if the Client fails to make payment for any Securities purchased by the Company on the Client’s behalf pursuant to the Electronic Services or fails to deliver any Securities for which the Client is liable to deliver to the Company on the Settlement Due Date, the Company shall be entitled to sell-out or buy-in such Securities as may be required to clear the Client’s position with the Company, without notice to the Client. Any selling-out or buying-in, as the case may be, shall be affected in accordance with the BMSB and/ or any other Exchanges’ Rules. | |

| 5.11 | The Company shall not be liable to the Client for any loss or damage suffered by the Client as a result of any fall or rise in the market price of the Securities between the first day the right to sell-out or buy-in, as the case may be, arose and the day the Company actually sells or purchases the relevant Securities. The Client acknowledges that a prior demand or call shall not be considered a waiver of the Company’s rights under this clause. The Client shall indemnify the Company for all losses incurred in respect of or arising from any liquidation or purchase of Securities as aforesaid. | |

| 5.12 | Notwithstanding that all shares, stocks or other Securities in the Client’s Account(s) are registered in the Client’s name, the Client shall hold, dispose of or otherwise deal with the Securities in the manner prescribed and acceptable by the Company and save and except for any act(s) of fraud or gross negligence, the Company shall not be held liable for any reasons whatsoever by reason of prescribing such manner of disposal of or dealing with the said Securities should the Client suffer or incur any losses, liabilities, damages, claims, interests, charges, expenses, costs and/ or any other adverse consequences resulting from such prescription by the Company. | |

| 5.13 | All instructions received by the Company which the Company in good faith believes to have been made by the Client shall remain effective for the protection of the Company in respect of payments made/instructions implemented in good faith notwithstanding the death, bankruptcy, winding-up order/the revocation of any instructions by any means, until written notice with documents evidencing the death, bankruptcy, winding-up order/ such revocation is received by the Company. | |

| 5.14 | The Company makes no recommendation, advice or representation for any Securities or potential value or suitability of any transaction or investment strategy which are suitable for the Client’s investment objectives, financial background and other particular needs. The Client acknowledges that the Client shall not in any event rely on any representation or advice by the Company, its employees, CMSRLH and agents without the Client independently verifying the same and/or determining that the information is reasonable to be relied upon. The Client acknowledges that instructions executed by the Executing Broker are made at the Client’s sole risk,and are accepted by the Company on the basis that they constitute the Client’s independent judgment. The Company shall not be liable for any losses suffered by the Client arising from any execution of the Client’s instructions and/or the Client’s failure to exercise reasonable care and diligence. | |

| 6. | CLIENT’S ACCOUNT(S) – OPERATIONS AND ADMINISTRATION | |

| 6.1 | The Client hereby irrevocably and unconditionally authorises the Company, to the extent permitted by law, to carry out any of the following: | |

| 6.1.1 | debit any of the Clients’ Account(s) in respect of any Indebtedness; | |

| 6.1.2 | set off against any Client’s Account(s) in or towards settlement of the Indebtedness or any part thereof | |

| 6.1.3 | suspend or close any of the Client’s Account(s) without giving any reasons whatsoever; | |

| 6.1.4 | offset, assign, hypothecate or otherwise deal with any securities, or any Client’s Account(s) with a credit balance, including cash or securities as well as any monies receivable arising from dividend payment or corporate action, or such securities pledged/ charged (whether legally or equitably) as Collateral toward settlement of the Indebtedness and/or any outstanding amount owing under the Client’s Margin Account, or any part thereof. The Client hereby further authorizes the Company to utilise part or all of any monies as may be held by the Company under any trust relating to Client’s monies (including monies paid into the trust account pursuant to Section 111 of the CMSA) to set-off the debit balance in any of Client’s Account(s) and the Clients’ Margin Account; | |

| 6.1.5 | place the Client’s name on any defaulter’s list with BMSB or notify BMSB and/ or any Foreign Exchanges pursuant to any of the Exchanges’ Rules; and | |

| 6.1.6 | sell any Securities held in any of the Client’s Account(s). | |

| 6.2 | As investment in Securities involves risk, the Client agrees that the Company shall have the right at any time at its absolute discretion to limit any purchase or sales ordered by the Client and shall not hold the Company liable for any loss arising from such limitation of purchases or sales ordered. The Client agrees that the Company has the right to impose any security or deposit requirement on the Client to secure the purchase of any Securities deemed as high risk by the Company at the absolute discretion of the Company. | |

| 6.3 | The Client hereby represents and warrants to the Company that the Client has good title to such shares, stocks or other securities that the Client may sell through the Company. | |

| 6.4 | The Company shall not be obliged to place any surplus funds in interest-bearing time deposit accounts. | |

| 6.5 | Where the Company is of the view, at its sole discretion, that the continued operation of the account(s) of the Client is not to the mutual benefit of the Company and the Client, the Company may forthwith close or suspend the Account. In the event of suspension, the Company need not stipulate a time period for the suspension. | |

| 6.6 | In the event of the failure of the Client to settle or deliver the securities to the Company or the Executing Broker or the Margin Financier (as the case may be) within the required time-frame for the trading of Securities, the Client authorizes the Company or the Executing Broker or the Margin Financier and/ or their respective CMSRLH at its absolute discretion to carry out such “selling-out” or “buying-in” of Securities to clear the Client’s position with the Company or the Company Agent. | |

| 6.7 | The Client authorizes and empowers the Company and/ or the Executing Broker, Margin Financier and/ or their respective CMSRLH to handle any of the Client’s Account(s) (including the Client’s trust account) or Client’s Margin Account (as the case may be) to carry out the following functions in the name of the Client, to do and/ or execute either jointly or severally as and when they shall deem fit, any of the following: | |

| 6.7.1 | issue instructions for the withdrawal of funds from the Client’s trust account for payment to the Client only; and/ or | |

| 6.7.2 | effect and/ or make payment to the Company or in the absence of specific instructions from the Client, issue instructions for the deposit of any payment (whether by telegraphic transfer or electronic fund transfer) for transactions carried out by the Client with the Company including but not limited to securities purchased or monies deposited with the Company. | |

| 6.8 | The Client agrees that though the Client’s CDS account is linked to the Client’s various trading accounts with the Company, the Client agrees that should the Client decide to contra the Client’s trades, the Client shall only conduct its sale transactions through the same account in which the Client purchased the shares in question. In the event of the Client failing to abide by the aforesaid rule, the Company is authorized to net-off the Client’s sale transaction through the second (2nd) account against the Client’s purchase transaction through the first (1st) account. The Client further agrees that the Company is at liberty to impose a service charge, to be fixed by the Company, which may be varied from time to time (with or without notice to the Client) against the Client in the event of the Company having to net-off the Client’s purchase and sale transactions as mentioned above. The Client agrees and authorizes the Company to deduct the aforesaid service charge from the sale proceeds. Any shortfall between the purchase price and sale proceeds shall be a debt due from the Client and without demand, be forthwith payable to the Company. | |

| 6.9 | The Client irrevocably authorises the Company to utilise the Client’s sale proceeds, contra gains or any sum standing to the credit of any of the Client’s Account(s) and/or Client’s Margin Account to set-off any amount due and outstanding under any trading accounts maintained by the Client with the Company in any manner the Company deems fit and whether the transactions are effected on the same exchange or different exchanges and whether effected under the same trading account or different trading accounts. | |

| 6.10 | All deposits placed with the Company are not insured under the Malaysian Deposit Insurance System or Perbadanan Insurans Deposit Malaysia (“PIDM"). | |

| Contra Trading and Settlement Terms | ||

| 6.11 | The terms under this Clause 6.11 is applicable for Contra Account only. Settlement by way of “contra” to set off outstanding purchase positions against outstanding sale positions of the same Securities for ‘ready basis’ contracts may be allowed at the discretion of the Company. If so allowed, such settlement shall be further subject to the following terms: | |

| 6.11.1 | contra settlement is not permitted for Securities which have been declared as ‘designated Securities’ or have trading restrictions imposed by BMSB or for contracts done on an ‘immediate basis’; | |

| 6.11.2 | any sales made up to the due date for outstanding purchases as prescribed by BMSB from time to time will be automatically set-off by way of contra on a first-in first-out basis; | |

| 6.11.3 | contra of purchase positions against subsequent sale positions made on or before the Settlement Due Date of the purchase date are not subject to funding interest on the purchase positions. However, funding interest is chargeable on any outstanding purchase contract amount which remains unsettled after the Settlement Due Date at such rate and for such duration as shall be determined by the Company from time to time; | |

| 6.11.4 | interest is chargeable on all outstanding contra losses commencing the day after the contra loss crystallized at the prevailing interest rate calculated. Any indulgence granted on the calculation of interest shall not constitute a waiver of the Company’s rights; | |

| 6.11.5 | the abovementioned interest charges will either be deducted from the gain or added on to the losses arising from the relevant contra transactions; | |

| 6.11.6 | any contra gain made by the Client will be paid by the Company to the Client after first deducting any outstanding contra losses, interests and/ or any other monies due payable and/ or owed by the Client; | |

| 6.11.7 | in the case of suspended counters, the Company has the right to close-off the purchase position upon the lifting of suspension; | |

| 6.11.8 | the contra trading and settlement guidelines above are subject to change from time to time by the relevant regulatory bodies and/ or at the discretion of the Company; and | |

| 6.11.9 | the Company may impose a contra service fee on the Client at a rate to be determined by the Company from time to time for permitting settlement by way of contra. This may be computed based on the value of the purchase contract settled by contra. | |

| 6.12 | The Client hereby unconditionally authorises the Company, the Executing Broker or its officer, employee or agent to act on the Client’s behalf: | |

| (a) | to print out ad hoc statement(s) and any other statement(s) from or in relation to the Client’s Accounts; and | |

| (b) | to perform or carry out balance inquiry(ies) of the cash, shares, stocks or other securities in the Client’s Account(s). | |

| 7. | LIMITS AND RESTRICTIONS | |

| 7.1 | The Client agrees and acknowledges that the Company may at any time set, vary or cancel the limits for any transaction type, facility, service and product that may be carried out or provided through the Electronic Services, whether in monetary or numerical terms or otherwise, and to vary the frequencies and availability. | |

| 7.2 | The Company may limit, cancel or suspend the Electronic Services in whole or in part at any time without giving any reason or prior notice and without incurring any liability and may add to, withdraw or change the types of transactions that may be available or carried out through the Electronic Services. | |

| 7.3 | In the event the Client is in default of any of the Client’s payment obligations hereunder, the Client hereby irrevocably authorizes the Company to take all action including to act on the Client’s behalf, to realize or sell a portion or all of the Collateral or take all such action as the Company deems fit (including but not limited to liquidation of the Collateral prior to its maturity or conversion of the same into other currencies) and in so doing, the Company shall not be liable for any losses arising. The Company is entitled to use its discretion in all aspects on sale or liquidation of the Collateral including matters relating to timing which may have an effect on the price(s). | |

| 7.4 | Any proceeds remaining after deduction of all costs and expenses in connection therewith and payment of all amounts due hereunder, shall be paid to the Client. In the event such proceeds are insufficient to cover such payments, the Client shall pay to the Company forthwith upon demand the amount of any deficiency. | |

| 7.5 | The Client hereby authorizes the Company to place the proceeds of any Collateral to the credit of any account with a view to preserving the Company’s rights to prove the whole of the Company’s claims against the Client and the Company may apply any or all of such proceeds to such account, in order to fulfill the Client’s obligation or liability to the Company, as conclusively determined by the Company. | |

| 8. | PAYMENT | |

| 8.1 | Save for the registration fee in clause 4.7, the Client shall effect payment into the bank account of the Company by way of electronic fund transfer or by way of telegraphic transfer for all purchase of Securities, fees, charges, expenses and interest payable to the Company in connection with the Electronic Services. The Client shall ensure that it has sufficient funds to fulfill any and all payment obligations when due. | |

| 8.2 | The Client shall pay to the Company, by the relevant and applicable due date, as the case may be, all and any losses, charges, penalties, fees, commissions, brokerage charges, trading losses, fines, debts, interests (at such rate as may be determined by the Company from time to time before and after judgment), damages, expenses and costs (including solicitors’ fees on a full indemnity basis) of whatever nature (whether actual or contingent) which the Company may at any time or from time to time sustain, incur or suffer by reason of or as a consequence of or arising in any way out of or in connection with or incidental to: | |

| 8.2.1 | the opening and operation of all or any of the Client’s Account(s), Client’s Margin Account including but not limited to trading and settlement of any trades or investments carried out by the Client via the Client’s Account(s) and/or Client’s Margin Account; and/ or | |

| 8.2.2 | the provision of Electronic Services and/ or facilities hereunder; and/ or | |

| 8.2.3 | any default arising from the Indebtedness of the Client. | |

| 8.3 | The Company’s statement to the Client as to the amount due and payable to the Company shall, save for manifest error, be conclusive evidence that such amount is in fact due and payable and binding on the parties hereto for all purposes, including legal proceedings. The Client is also advised to check the statement to ensure all payments made by the Client have been received by the Company and provided for in the statement. The Client should notify the Company within the time period stated in the statement upon receipt of the statement in the event of any discrepancies, failing which the contents of the statement shall be deemed as true and correct. | |

| 8.4 | The Company shall at all times have a general and continuing lien over all the securities in its custody to secure the payment of all monies due and payable to the Company in furtherance of which the Client hereby irrevocably authorizes the Company to deal, in any manner whatsoever as the Company shall deem fit, with all or any of the securities for or under the Client’s Account(s). | |

| 8.5 | Payment(s) for Securities purchased are to be made by way of telegraphic transfer or by way of electronic fund transfer in the manner as may be notified to the Client by the Company and unless otherwise agreed to by the Company may only be made in Malaysian (MYR) currency. The Client understands that all payment(s) made shall only be deemed received by the Company from the Client when the Company has issued a notification and/ or system generated statement to the Client for the same. The Client also understands that it is the Client’s responsibility to insist on the issuance of the Company’s receipt acknowledgement and that the Company shall not be held liable or responsible for the Client’s failure to obtain the notification or system generated statement. | |

| 8.6 | The ‘rounding mechanism’ shall be applicable to all over-the counter payment(s) at any bank counters, whether payment(s) are made in cash or otherwise and only applies to the total amount of a bill and not on individual items. In the ‘rounding mechanism’, the total amount of a bill which ends in 1, 2, 6 and 7 sen will be rounded downwards to the nearest multiple of 5 sen while the total bill which ends in 3, 4, 8 and 9 sen will be rounded upwards to the nearest multiple of 5 sen. | |

| 8.7 | The Company is not responsible for any errors, inaccuracies or omission in the information that may be displayed or transmitted by any licensed financial institution or any online payment gateway system to the Client for the purpose of facilitating interbank transfer of funds. Such errors, inaccuracies or omissions shall not prejudice or affect in any way the Client’s obligation to pay all and any amounts due and owing to the Company. | |

| 9. | TERMS AND CONDITIONS GOVERNING THE CLIENT TRUST ACCOUNT | |

| 9.1 | The Client’s trust account is subject to the Company’s continued discretion to grant, maintain and operate. The Client represents and warrants that the Client has full power and capacity to open the Client’s trust account and will not by so doing contravene or result in a default under any provision of any applicable Laws and Rules or of any judgment, injunction, order, decree or agreement or instrument binding upon the Client. | |

| 9.2 | In addition to, and not in derogation of the terms and conditions set out herein, the Client hereby irrevocably and unconditionally agrees to the following in respect of the Client’s trust account: | |

| 9.2.1 | That all monies which have been deposited into the Client’s trust account shall be dealt with in accordance with the terms and conditions herein. | |

| 9.2.2 | As and when any of the Client’s purchase orders for shares, stocks or other Securities have been executed by the Company on the Client’s behalf on any day, the Company shall be entitled to immediately earmark or set aside the relevant amount of monies from the Available Funds for settlement of the purchase price of the said shares, stocks or other Securities and all of the transaction costs payable by the Client in connection with the said purchase ("Earmarked Amount"). On the relevant settlement date as may be prescribed or amended from time to time by BMSB or any other relevant authorities, the Company shall be authorised to utilise the Earmarked Amount to settle the costs payable by the Client in connection with the said purchase. The Client further agrees and acknowledges that the Client shall not be entitled to contra the said purchase price and transaction costs against the proceeds from the execution of any subsequent sale orders for Securities on the Client’s behalf by the Company unless allowed pursuant to the discretion of the Company pursuant to Clause 6.11. | |

| 9.2.3 | The Client hereby authorises the Company to credit all proceeds due to the Client on the settlement of any sale order for all or any of the Client’s shares, stocks or Securities at any time, into the Client’s trust account and thereafter the Client agrees that such proceeds shall form part of the Available Funds and shall be dealt with in the same manner as all other monies in the Client’s trust account. | |

| 9.2.4 | The Client may withdraw any sum, or a minimum amount as may be prescribed by the Company in its absolute discretion from time to time, subject to the sufficiency of Available Funds. The Client further agrees to make withdrawals by giving a written request, or any other form of notice prescribed by the Company from time to time, to the Company on any market day subject to such conditions as the Company may prescribe or impose on such withdrawals at its absolute discretion from time to time. The Client agrees and undertakes to maintain a minimum amount as may be prescribed by the Company at its absolute discretion in the Client’s trust account at all times and upon the Client’s submission of the said written request or notice for withdrawal, the Client agrees and undertakes not to place any purchase orders for any shares, stocks or other securities in excess of the balance of the Available Funds after deduction of the proposed amount to be withdrawn. | |

| 9.2.5 | In addition and without prejudice to any other provisions herein, the Client hereby irrevocably and unconditionally, agrees, consents, directs and authorises the Company to utilise the Available Funds at any time and from time to time to set-off, repay, settle and discharge the following: | |

| 9.2.5.1. all monies due and owing by the Client to the Company under all of the Client’s Accounts with the Company or otherwise due to the Company for any reason whatsoever (including monies due and owing by the Client to the Company in respect of the Client’s other dealings and transactions with or through the Company); and | ||

| 9.2.5.2. all monies due and owing by the Client to any of the companies appointed by the Company in relation to the Electronic Services. The Client further undertakes to pay the Company forthwith any shortfalls or balances due and owing in or under all of the Client’s Accounts in the event that the Available Funds are insufficient to settle all monies due and owing by the Client and indemnify the Company for all losses, liabilities, damages, interest, costs, expenses and charges sustained or incurred by the Company in connection with the Client’s Accounts or the Client’s trading activities. | ||

| 9.2.6 | The Client hereby agrees that the Company shall be entitled to determine and calculate the available limit for the Client’s trades in securities in the manner determined by the Company in its absolute discretion. Without prejudice to the foregoing, the Client agrees and acknowledges that all Earmarked Amounts shall be deducted from the Available Funds when calculating the Client’s available limit for the Client’s trades in securities. | |

| 9.2.7 | In the event any of the Client’s purchase orders for any shares, stocks or Securities has been executed and it is thereafter discovered that the aggregate of the purchase price and the transaction costs payable by the Client in connection with that purchase order is greater than the Available Funds (the excess shall be known as the "Excess") for any reason whatsoever, including any errors or omissions on the part of the Company in calculating the Available Funds and the Client’s trading limit, the Client hereby undertakes to pay to the Company the Excess in immediately available funds on the market day immediately following the transaction date of the said purchase order failing which, without prejudice to all its rights and remedies, the Executing Broker shall be entitled to charge and impose on the Client the normal brokerage rate chargeable for the execution of purchase orders for a normal trading account in respect of that purchase order and the Client shall be liable to pay brokerage to the Executing Broker at the said rate in respect of that purchase order. | |

| 10. | CASH UPFRONT | |

| 10.1 | The Cash Upfront Trading Account is an account where all purchase transactions must be supported by the prior deposit of sufficient funds to settle the relevant purchase transaction. | |

| 10.2 | To utilize this account, the Client is required to place a deposit sum prior to the Client’s trading. The Client understands and accepts that the use of the Cash Upfront Trading Account shall be subject to the following: | |

| 10.2.1 | brokerage rates and charges will be informed via email or through the Company’s prevailing Electronic Services and/ or the Company Website or any other manner the Company may specify from time to time at its sole and absolute discretion; | |

| 10.2.2 | the Client’s strict compliance with any security/collateral requirements that may be imposed by the Company from time to time at the Company’s sole and absolute discretion; and | |

| 10.2.3 | any other requirements that may be imposed by the Company from time to time at the Company’s sole and absolute discretion. | |

| 10.3 | The Company shall not be liable to the Client for any loss or damage suffered by the Client as a result of any fall or rise in the market price of the Securities between the first day the right to sell out or buy-in, as the case may be, arose and the day the Company actually sells and/ or purchases the relevant Securities. The Client acknowledges that a prior demand or call shall not be considered a waiver of the Company’s rights under this clause. The Client shall indemnify the Company for all losses incurred in respect of or arising from any liquidation or purchase of Securities as aforesaid. | |

| 10.4 | The Client may terminate the Cash Upfront Trading Account by giving written notice to the Company, subject to the following conditions: | |

| 10.4.1 | the Client has liquidated all its Securities prior to termination of the Cash Upfront Trading Account; | |

| 10.4.2 | the Client has settled all outstanding obligations; and | |

| 10.4.3 | notwithstanding the above, the Client shall remain liable for the payment of all charges and shall indemnify the Company for all losses in respect of or arising from any liquidation or any settlement of Securities. | |

| 11. | CUSTODIAN AND NOMINEE ACCOUNTS | |

| 11.1 | The Client agrees and acknowledges that the Client’s Securities shall be held by a custodian and/ or nominee to be appointed by the Company and agrees to be bound by the terms set out in this Clause 11. | |

| 11.2 | The Company may receive and hold in custody under such custodian/ nominee such Securities that are delivered to or deposited with the Company. The Company may also from time to time procure that custodian and/ or nominee services be carried out through any sub-custodian (whether associated with the Company or not) or any Securities depository or depository agent (all of which such entitles to be hereafter referred to as “sub-custodians”, and any of which a “sub-custodian”) and where such sub-custodian holds the Securities subject to terms and conditions in addition to those set out hereunder, then the Client agrees to also be bound to such terms in addition. The Company shall have no liability to the Client for any acts and omissions of such sub-custodian. | |

| 11.3 | To the extent that any such Securities are deposited with or held through third parties whether in Malaysia or elsewhere, the Client acknowledges that the Company may have principal liability in connection therewith and the Client agrees that the Company may take such action as it deems fit in relation to the Securities in order to avoid loss, damage, costs charges and/ or expenses charged by such third party. | |

| 11.4 | The Client is advised to inquire from the Company about the type of custodian and/ or nominee services provided by the Company from time to time. | |

| 11.5 | In providing any custodian and nominee services, the Company or the relevant custodian/sub-custodian and/ or nominee shall maintain records which identify the Securities attributable to the beneficiary. | |

| 11.6 | The Company or the relevant sub-custodian and/ or nominee is authorised but not obliged, at its discretion, to take such steps as it may consider expedient to enable it to provide its services and to exercise its powers under the terms and conditions herein, including the right: | |

| 11.6.1 | to comply with any law, regulation, order, directive, notice or request of any government agency (whether or not having the force of law) requiring the Company or the relevant sub-custodian to take or refrain from action; | |

| 11.6.2 | to withhold and/ or make payment of any taxes, charges or duties payable on or in respect of Securities on behalf of the Client; | |

| 11.6.3 | in the absence of or delay in receiving instructions from the Client in response to a request for the same, to refrain from acting without any liability to the Client; and | |

| 11.6.4 | to participate in and to comply with the rules and regulations of any system which provides central clearing and settlement facilities in respect of Securities. | |

| 11.7 | The Company will use its reasonable endeavours upon its actual receipt or notice of any right to subscribe for share, warrants, bonds or other Securities offered or accruing to the benefit of the Securities which have been purchased or held on the Client’s behalf in so far as the Securities are registered in the name of or held on the Client’s behalf to the control or direction of the Company, (collectively “Rights”) to notify the Client of the same in accordance with these terms and conditions. If the Client wishes to exercise all or part of such Rights or to apply and subscribe for additional Securities, the Client shall give such instructions to that effect to the Company on or before the deadline indicated or notified by the Company for compliance with any instruction as aforesaid and where necessary make the necessary payments and provide or fulfill such further conditions and indemnities and provisions for expenses as the Company or the relevant custodian, sub-custodian or nominee may require in its discretion, in reasonably sufficient time for the Company to exercise or procure the execution of such instructions. The Client acknowledges that the Company or the relevant custodian, sub-custodian and/or nominee requires at least three (3) Business Days to perform such instructions. The Company or the relevant custodian, sub-custodian and/or nominee shall not be obliged to use more than its reasonable endeavours to execute the Client’s instructions as aforesaid, and the Company or the relevant custodian, sub-custodian and/or nominee shall have no liability if notwithstanding reasonable efforts, the instructions are not executed for any reason. For the avoidance of doubt, if the Company does not receive any notification of the Rights for any reason whatsoever or if no instructions from the Client (accompanied by payment where applicable) with respect to any Rights is received within the stipulated time, the Company shall not be liable for any non-exercise of all or any part of the Rights. | |

| 11.8 | The Company or the relevant custodian, sub-custodian and/ or nominee shall be under no duty or responsibility to investigate, participate or take any action concerning attendance at meetings, voting or other rights or enforcement of rights of whatever nature attaching to or derived from the Securities. The Company may in its discretion act on written instructions given or purported to be given by the Client which appear to be bona fide and upon such terms and conditions and indemnities and provision of fees, charges and expenses as the Company may require. The Company shall not incur any liability on any such instruction should there in fact be any delay, errors, ambiguities or other irregularities therein or therewith. | |

| 11.9 | The Company may appoint nominees/delegates or any sub-custodian (or its nominees), where due to the nature of the law or market practice of any relevant jurisdiction, it is in the Client’s best interest or it is feasible to do so and/ or to perform any of the services on its behalf and may delegate any of its powers herein to such person. | |

| 11.10 | In arranging custodian and/ or nominee services to be provided to the Client, the Client agrees and accepts that the Company and the relevant custodian/ sub-custodian and/ or nominee: | |

| 11.10.1 | is not as trustee and shall have no trust or other obligations in respect of the Securities in relation to the provision of services except those contained herein or as otherwise agreed by the Company or the relevant custodian/ subcustodian and/ or nominee in writing; | |

| 11.10.2 | is not acting under these terms and conditions as an investment manager or investment advisor to the Client; | |

| 11.10.3 | shall not be liable for any taxes or duties payable on or in respect of the Securities nor for any diminution in the value of the Securities; | |

| 11.10.4 | shall not be liable for losses of any kind which may be incurred by the Client (whether or not the Beneficiary is insured) as a result of the provision of the services or as a result of the Company and the relevant custodian/ subcustodian and/ or nominee exercising any or all of its rights and discretion as herein provided, unless due to the gross negligence or wilful default of the Company and the relevant custodian/sub-custodian and/ or nominee in which event the liability of the Company and the relevant custodian/sub-custodian and/ or nominee shall not exceed the market value of the Securities at the time of such gross negligence or wilful default, in respect of which the loss or damage is found to have arisen; | |

| 11.10.5 | shall not be liable for losses of any kind which may be incurred by the Client including but not limited to any negligence, wilful default, fraud, computer errors and other irregularities of whatsoever nature and howsoever arising as a result of participating in the services referred to herein by the Company and the relevant custodian/subcustodian and/ or nominee and provided by Bursa Depository (including any other party in substitution thereof from time to time), its employees, servants or agents in accordance with the instructions of the Client; | |

| 11.10.6 | shall be entitled but not obliged to rely or act upon, in the performance of its duties under these terms and conditions and without liability on the part of the Company and the relevant custodian/ sub-custodian and/ or nominee, any communication or any document believed by the Company and the relevant custodian/ sub-custodian and/ or nominee in good faith to be genuine and in the case of any instruction, believed in good faith to be genuine, accurate and duly given by the Client or any person the Client authorizes; | |

| 11.10.7 | shall not be liable for losses of any kind which may be incurred by the Beneficiaries as a result of the provision of the services or as a result of the Company and the relevant custodian/sub-custodian and/ or nominee exercising any or all of its rights and discretion as herein provided in this Clause 11, or as a result of the Company and the relevant custodian/sub-custodian and/ or nominee relying on any of the authorizations, confirmations, undertakings, covenants, representations and warranties contained herein or arising from any wrongful, unauthorised, erroneous or negligent acts or omissions by the Client; and | |

| 11.10.8 | shall not be liable or responsible for any failure to perform any of its obligations herein or any breach if such breach or performances is prevented, hindered or delayed due to compliance with any laws, rules, decrees, orders, regulations or government acts of any authority, court or internal policies. | |

| 11.11 | Custodian and/ or nominee services provided by or through the Company shall be at the Client's cost and expense. | |

| 11.12 | Where the Securities are deposited with a sub-custodian the Client agrees that the Company shall not be liable in contract,tort (including negligence or breach of statutory duty), equity or otherwise, for any damages, losses, expenses, costs or liabilities whatsoever (whether direct or indirect, or whether foreseeable or not) suffered or incurred by the Client by reason of or in consequence of or in connection with or arising out of the Company delivering the Securities to such sub-custodian including but not limited to the following circumstances: | |

| 11.12.1 | any securities being lost, stolen or destroyed in transit during delivery; or | |

| 11.12.2 | any loss of opportunity whereby the value of the Securities could have been increased or for any decline or loss in value of the Securities, for whatever reason: | |

| even if advised of the possibility of such damages. Without prejudice to the generality of the foregoing the duty of the Company in respect of such Securities shall be limited to acting in good faith in respect to any action or inaction in relation to the custody of such securities. The Company shall be under no duty to insure the Securities held by it and shall not itself be deemed to be insurer thereof and the Securities whether held by the Company or deposited with a sub-custodian are held (subject to the good faith duty of the Company as custodian) at the Client’s sole risk in every respect. The Company shall be under no duty to act on any notices of any issuers of Securities, whether the same include notices of rights or bonus issues, or of meetings or otherwise, in the absence of any instructions from the Client. | ||

| 11.13 | The Client warrants that the Securities deposited by the Client or the Client’s agent with the Company are free from all claims and encumbrances other than those notified in writing to the Company at or prior to such deposit and the Client are beneficially entitled to all the interest in the same. The Client shall not without the consent in writing of the Company assign, transfer, dispose of, create or attempt to create any security or encumbrance over all or any of the Security in custody of the Company in favour of anyone other than the Company. | |

| 11.14 | Upon the Client’s request and at the Client’s sole risk and subject to the Client indemnifying the Company against any or all adverse consequences that the Company and/ or the sub-custodian and/ or nominee may incur or suffer (whether as a consequence of any implication in law or otherwise) relating to any such registration, the Company and/ or the sub-custodian and/ or nominee may in its discretion submit any Securities for the purpose of registration provided that the Client shall sign and execute all instruments of transfer and any and all documents and do all other acts reasonably or incidentally required thereof. | |

| 11.15 | The Company and/ or the sub-custodian and/ or nominee is not obliged to act on any instruction relating to any Securities that are not in the custody of the Company, but if it does so, the Company shall be indemnified by the Client for any and all loss that it may thereby incur. For avoidance of doubt, the compliance by the Company and/ or the sub-custodian and/ or nominee with any of the Client’s instructions as aforesaid shall not be deemed as acceptance or acknowledgment by the Company and/ or the sub-custodian and/ or nominee that it in fact has the Securities (being the subject matter of the instructions) in custody. | |

| 11.16 | Unless otherwise expressly provided, an instruction pursuant to Clause 11.7 shall continue in full force and effect until cancelled or superseded by subsequent instructions received and accepted by the Company. | |

| 11.17 | The Company and/ or the sub-custodian and/ or nominee shall be under no obligation to notify the Client or convert any Securities evidenced by physical scrips (“Scrip Securities”) in its custody to Book-Entry Securities when the counter to which the Scrip Securities relate are designated for conversion into Book-Entry Securities and the Company and/ or the subcustodian and/ or nominee shall have no liability in this respect so long as it has acted in good faith. The Company and/ or the sub-custodian and/ or nominee also shall be under no duty to permit or procure the withdrawal or conversion of Book-Entry Securities into Scrip Securities. | |

| 11.18 | Without limiting the generality of Clause 11.17 above, upon the Client’s request and at the Client’s sole risk, the Company and/ or the sub-custodian and/ or nominee may in its absolute discretion deposit Scrip Securities with a relevant depository whether in the name of a depository agent or in the Client’s name for conversion into Book-Entry Securities, or vice versa as the Company and/ or the sub-custodian and/ or nominee shall at its discretion decide provided that the Client shall sign and execute all instruments of transfer and any and all documents and do all other acts reasonably or incidentally required therefore. | |

| 11.19 | Without prejudice to the foregoing, the Company has an absolute discretion but not an obligation to resort to and appropriate any Securities in its custody for the settlement of any trade done by the Client. The Company shall at all times have a general and continuing lien over all or any of the Securities in its custody to secure the payment of all monies now or later due payable actually or contingently whether under these terms and conditions or otherwise howsoever. Additionally, all the Client’s Accounts with the Company, so far as the law permits, shall at the option of the Company be deemed to be a single running account and/ or the Company shall have the right to combine all or any of the Client’s Accounts from time to time and at any time without giving notice to the Client. Further, the Company may set-off from time to time and at any time any obligation owing by the Client (whether arising under these terms and conditions or not) against any obligation owing by the Company (whether arising under these terms and conditions or not). Further without prejudice to any other right that the Company may have (whether hereunder or under law), it may retain the Securities by way of a charge to secure the payment of all monies now or later due payable actually or contingently whether under these terms and conditions or not, and if the Client fails to settle any outstanding sums due within fourteen (14) days after a demand or payment is mailed by registered post addressed to the Client at the Client’s address, then the Company may have all or any of the Securities registered in the name of the Company or of others appointed by the Company and to sell or dispose in such manner of sale, transfer or disposition as the Company deems fit all or any of the Securities upon such terms and conditions as the Company may see fit, and to apply the proceeds of any such sale, transfer or disposition towards settlement (whether in part of wholly) of any outstanding sums owed by the Client to the Company. | |

| 11.20 | Any stamp duty payable shall be paid by the Client and if the Company pays the same first, then the Client shall indemnify and pay the Company for the same immediately on the request of the Company or demand for the same, failing which the Company may exercise its rights as set out in Clause 11.19 towards payment of the stamp duty paid by the Company. | |

| 11.21 | The Client agrees and acknowledges that rights generally available or accruing to the holder of any Securities may under the laws of foreign jurisdictions, not be available to or accrue to the benefit of or be offered to the Client and the Client agrees that in such circumstances, the Company shall not be responsible to inform the Client, inquire, investigate, take any action or make any demands in relation to such rights and the Client shall have no recourse against the Company for any claims whatsoever arising out of or in connection with or in relation to such rights. | |

| 11.22 | The Company and/ or the sub-custodian and/ or nominee shall have no duty or responsibility to notify the Client of any proxy or other documents received by it in respect of the Securities held or registered with the Company or to send any proxy or other documents to the Client. | |

| 11.23 | The Client agrees to pay such fees and charges as the Company may from time to time prescribe in consideration of its services under this Clause 11 and all reasonable expenses paid or incurred by the Company, its agents or employees with respect thereto and the Company may deduct any amount due to it against any of the Client’s Account(s) with the Company which accounts if in debit shall be subject to the usual charges and interest of the Company. | |

| 11.24 | The Client hereby irrevocably and unconditionally agrees to the following in respect of the custodian and nominee account(s): | |

| 11.24.1 | all shares, stocks or other securities in the Client’s Accounts shall be registered in the Company’s custodian, subcustodian, or nominee’s name, and held in the Client’s favour; | |

| 11.24.2 | The Company’s, custodian, sub-custodian and/ or nominee shall hold, dispose of or otherwise deal with the said securities on the Client’s instructions in the form prescribed and acceptable by the Company and/ or the nominee and the nominee shall not be held liable for any reason whatsoever by reason of acting or omitting to act on any such instruction given or purported to be given should there be any error or ambiguity; | |

| 11.24.3 | All of the Client’s securities that are deposited with the Company’s custodian, sub-custodian or nominee (where relevant) shall be in the required or regular form and in good delivery order. The Client confirms and undertakes with the Company and the nominee that the securities deposited by the Client with the nominee are genuine and that the Client is the lawful and beneficial owner of the securities; and | |

| 11.24.4 | The nominee shall not be bound to return the identical securities deposited by the Client and the Client will accept securities of the same class or denomination in place of the securities deposited with the nominee. | |

| 11.25 | In addition and without prejudice to any other provision herein, the Client hereby irrevocably and unconditionally agrees, consents, directs and authorises the nominee to: | |

| 11.25.1 | request payment and receive all interest, dividends and other payments or distributions in respect of the Securities held; | |

| 11.25.2 | surrender the Securities against receipt of monies payable at maturity or on redemption if called prior to maturity at the Client’s request; and | |

| 11.25.3 | comply with the provisions of any laws or regulations now or hereafter in force which purport to impose on the holder of any securities a duty to take or refrain from taking any actions in connection with any of the Securities or payments or distributions or monies payable in respect of any of the Securities. | |

| 11.26 | The nominees shall not be under any duty or responsibility to take any actions or otherwise but shall not be precluded from so doing in its absolute discretion without reference or notice to the Client with regards to attendances at meeting or voting in respect of any of the Securities or as regards to any subscriptions, conversions or other rights in respect thereof or as regards any mergers, consolidations, reorganisations and any other corporate exercises. | |

| 11.27 | The Client shall pay such fees and charges as may be charged by the Company, custodian, sub-custodian or nominee from time to time for the custodian and nominee services hereunder, including all expenses incurred by the nominee or the nominee’s agents (“Fees”). The Client agrees and authorises the Company and/ or the nominee to deduct such fees from the Client’s Trust Account. In the event that there are insufficient funds for any reasons whatsoever, the nominee shall be authorised to without further reference to the Client and without prejudice to all the nominee’s rights and remedies, deduct any amounts due to it from any monies received by the nominee for the Client’s Account(s), and/ or to sell all or any of the Client’s securities in such manner and upon such terms and conditions as the nominee shall in its sole discretion think fit and to apply the net proceeds from any sales thereof in or towards the discharge of all amounts due and owing to the nominee or at the nominee’s discretion to hold them in suspense for whatever period as the nominee shall think fit. Notwithstanding anything aforementioned, such Fees and charges as may be charged by the nominee from time to time may be waived at the absolute discretion of the Company and/ or the nominee, subject to such conditions as may be imposed by the Company and/ or the nominee from time to time. Alternatively, the nominee may demand from the Client and the Client shall upon such demand pay to the nominee such amount as shall be sufficient to settle any deficit or dues owed by the Client. | |

| 11.28 | The Company, custodian, sub-custodian or nominee may, with or without the Client’s prior consent, deposit the Client’s Securities with other depositories. In any such cases, the terms and conditions imposed by such depositories shall apply and the nominee shall cease to be responsible in any way whatsoever for those securities so deposited with other depositories. | |

| 11.29 | The Client shall indemnify the nominee, its agent and correspondents against any and all expenses, liabilities, claims, demands and any other adverse consequences whatsoever in, under or arising out of the holding, disposal or delivery of the Securities or anything done in respect thereof. | |

| 11.30 | The nominee may at the Client’s expense seek the opinion or views of such professional advisers as the nominee may select and the nominee may, but shall not be required to, act thereon and shall have no liability whatsoever for any actions taken or omitted to be taken pursuant thereto. | |

| 11.31 | The custodian and nominee services will terminate upon the termination of the terms and conditions herein pursuant to Clause 15.1 below and upon the termination of the Client’s Account and/ or Electronic Services. | |

| 11.32 | Save and except for any members of the Company the nominee will not disclose to any third parties any information in the nominee’s books concerning Securities held unless compelled to do so by law. In the event the nominee discloses information to a third party as required by law, the Client hereby consents to such disclosure. | |

| 11.33 | The Securities are deposited with the nominee at the Client’s own risk and on the understanding that the nominee shall not be liable for any losses and damages or whatsoever acts or things done or omitted to be done in respect of the Securities except arising from or occasioned by the nominee’s wilful negligence or wrongful act. | |

| 11.34 | The nominee shall not be liable for any losses, delays or damages due to any causes beyond the control of the Company, custodian, sub-custodian or nominee and without limiting the generality thereof, including, acts of government, strikes, lockouts, fire, lightning, explosion, flooding, riots, civil commotions, acts of war, malicious mischief or theft. | |

| 11.35 | The Company, nominee, custodian or their agents are not obliged to and shall not give any recognition to any trusts or equities in respect of the securities or any part thereof lodged with them. | |

| 11.36 | For the avoidance of doubt, where the Client is and/or ceases to be a substantial shareholder or has changes in the voting shares of any company, the Company, custodian, sub-custodian and/or nominee shall not be under any duty or responsibility to notify the respective company and/or Client. The Client undertakes to notify the respective company as required by the Companies Act 2016 or any other law in a foreign jurisdiction and the Company, custodian, sub-custodian and/or nominee shall not be liable for any losses, damages or fines in the event the Client fails to notify the respective company. | |

| 12. | COLLATERALISED CONTRA TRADING ACCOUNT (“CONTRA ACCOUNT”) | |

| 12.1 | The Contra Account is an account where all purchase transactions by the Client are based on the trading limit as determined by the Company in its sole discretion. In order to open a Contra Account, the Client hereby agrees to mortgage, assign, charge and/ or pledge in the Company’s favour all the shares, stocks or other securities or cash, held from time to time in any of the Client’s Accounts which have been fully paid, including without limitation, in the Client’s custody account, the Client’s CDS account and the CDS account in the name of the Company, custodian, sub-custodian or nominee held in the Client’s favour. | |

| 12.2 | In addition and not in derogation of the above, the Client shall deposit with the Company in the accounts and/ or mortgage, assign, charge, pledge in favour of the Company such shares, stocks or other securities or cash, by and acceptable to the Company as collateral to secure all of the Client’s trading activities and monies, obligations and liabilities due and owing to the Company at any time and from time to time and the Client shall, at the request of the Company at any time and from time to time, substitute such shares, stocks or other securities with those acceptable to the Company at its absolute discretion. “Deposited Securities” means all such shares, stocks or other securities or cash as may be required mortgaged, assigned, charged and/ or pledged in the Company’s favour and/ or deposited and/ or held in the Client’s Account(s) and where the context permits or requires, any one or more of them. | |

| 12.3 | The Client confirms that it is the legal and beneficial owner of the Deposited Securities and that the Client is entitled to mortgage, assign and/ or pledge the Deposited Securities in favour of the Company. | |

| 12.4 | The Deposited Securities will be a continuing security to the Company for the general balance of the Client’s debts to the Company, which includes but is not limited to any monies now and hereafter due under the Client’s contra account. The Client shall make payment for any Securities in accordance with the fixed delivery and settlement system established under the BMSB rules and/or guidelines. | |

| 12.5 | If the Client fails to make payment for any Securities on the 2nd Business Day or any other Business Day as may be determined by the Company from time to time with prior notice to the Client from the date of purchase of the Securities, the Client hereby acknowledges and agrees to the following :- | |

| 12.5.1 | That the Company shall have the right to sell such Securities on the 3rd Business Day from the date of purchase pursuant to the rules and guidelines of BMSB without any prior notice to the Client. | |

| 12.5.2 | If there are contra-losses (including any fees, charges or expenses) as a result of the sale of such Securities, the Company shall immediately issue prior written notice to the Client requesting the Client to repay to the Company all sums of money due and owing. The Client hereby undertakes to settle and repay to the Company all sums of money due on contra losses (including any fees, charges or expenses) in respect of any Securities by the 5th Business Day from the date of purchase or any other date as determined by the Company in its sole discretion; | |

| 12.5.3 | If the Client fails to settle and/or repay to the Company all sums of money (including any fees, charges or expenses) due and owing on the contra losses on the 5th Business Day from the date of purchase, the Company shall be entitled to immediately sell the Deposited Securities on the 6th Business Day from the date of purchase without further notice to the Client; | |

| 12.5.4 | If the contra losses remain outstanding or is not fully satisfied by the 5th Business Day from the date of purchase, the Company may in its absolute discretion utilise any cash and/or sell, transfer, assign or otherwise deal with, in any manner, the Securities in any of the Client’s Account(s) including the cash up-front acount on the 6th Business Day from the date of purchase; and | |

| 12.5.5 | If the contra losses continue to remain outstanding or is not fully satisfied by the 6th Business Day, the Company shall initiate legal action against the Client without further reference to the Client. | |